carried interest tax concession

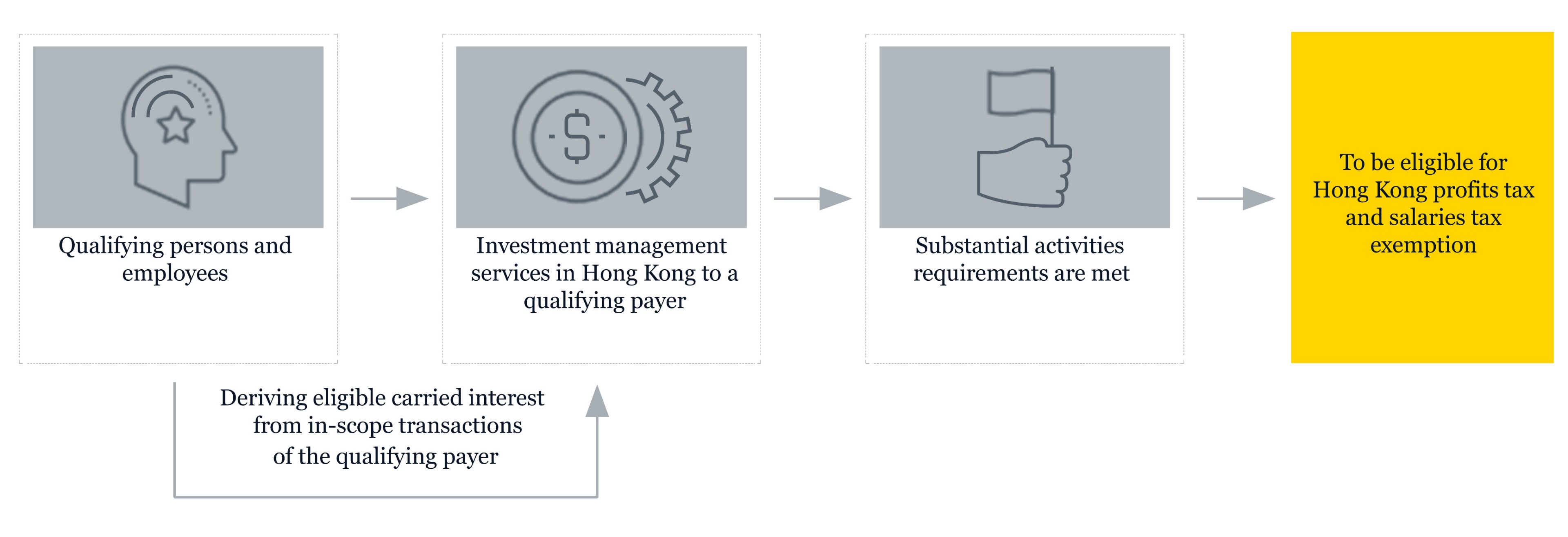

The Hong Kong Government introduced the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill on 28 January 2021. 1 For further information please refer to Dechert OnPoint Hong Kongs 0 Tax Concession for Carried Interest.

Zero Tax For Hong Kong S Carried Interest Tax Concession

Individuals who have received.

. Ushering in a 0 profits tax rate on eligible carried interest and excluding 100 of eligible carried interest from employment income for ascertaining the salaries tax liabilities. The Government today released the legislation on the concessional tax treatment for carried interest in Hong Kong. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was enacted to give profits tax and salaries tax concessions in relation to eligible carried.

On 29 January 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill was gazetted to amend the Inland Revenue Ordinance and. Under the Carried Interest Tax Concession Regime eligible carried interest will be taxed at 0 profits tax rate and all of the eligible carried interest would also be excluded from. On 7 May 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance came into operation introducing the much-anticipated Carried Interest Tax.

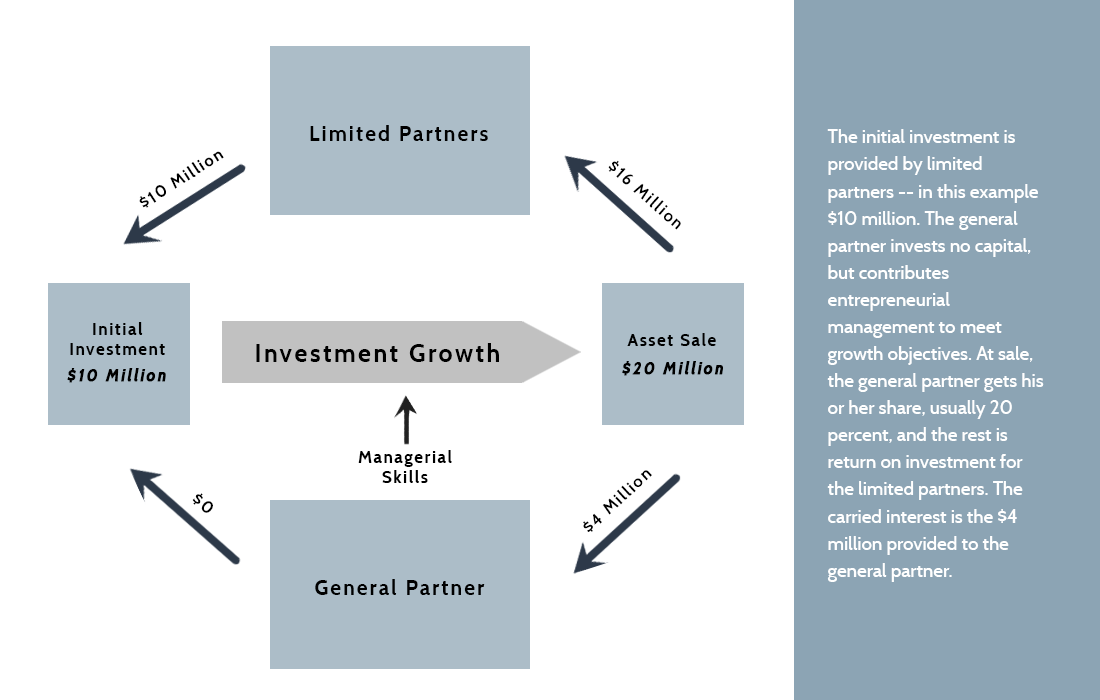

Carried interest earned by individuals. That is where an entity that is recipient of the carried interest return pays part of the return to its. The eligible carried interest distributions are to be taxed at a 0.

Enacting legislation to allow tax concessions for carried interest is part of a broader initiative over the past several years to enhance Hong Kongs competitiveness as a leading jurisdiction for. Only carried interest distributed out of tax-exempted qualifying transactions in private equity investments ie shares stocks debentures loan stocks funds bonds or notes of or issued. The tax concession for a carried interest also looks through to the employees.

As mentioned above the scope of the tax concession also extends to carried interest received by an individual assessable to salaries tax. 2 qualifying persons is defined in section 43 of Schedule. Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime offering tax.

Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax. The Bill proposes a tax regime offering. Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper.

11 rows In summary the profits of certain collective investment schemes derived from qualifying.

Yvette Chan On Linkedin Hong Kong Inland Revenue Department Introduces New Tax Concession

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

The Carried Interest Debate Is Mostly Overblown Tax Foundation

Webcast Hong Kong Tax Concessions On Carried Interest Sanne Group

Hong Kong Carried Interest Tax Concession Anrev

Asset Management Tax Update Kpmg China

How To Claim 179d Tax Deduction A Guide For A E Firms Cherry Bekaert

Fung Yu Co Cpa Limited Eligible Carried Interest For Fund Is Now Taxed At 0 In Hong Kong Applicable Retrospectively From April 2020 Http Www Fungyucpa Com Tax Concessions Hk Funds Facebook

The Fight Over The Carried Interest Loophole Smartasset

James Medlock On Twitter Gotta Hand It To The Lobbyists Who Have Been Working On Protecting Carried Interest Who Have Succeeded Despite The Last Two Presidents And Public Opinion Being Against Them

How Private Equity Won Its Battle Over Carried Interest Barron S

Carried Interest Tax Concession Regime Introduced A Pass Corporate Services Hong Kong

Brian Sullivan On Twitter Text From A Friend Who Is A Former Hedge Fund Exec On Carried Interest Tax Deduction Contributes To Inequality And Very Undemocratic All On Back Of Laying Off

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

The Tax Treatment Of Carried Interest Aaf

Are You Riding The Next Wave Of Growth In Hong Kong S Wealth And Asset Management Sector Ey China